insights

Your Guide To HS/HTS Codes

Moselle Research Team

When you look around your home or office, inevitably you will see many products brought to you by using intricate global supply trade chains. Oftentimes, the everyday consumer doesn’t understand just what these products go through to get to them. If you’re an entrepreneur that imports products though, it’s a different story.

When a product is making its way to another country, as it reaches the border they clear the country’s customs and the buyer must pay the corresponding duties & tariffs.

How does customs know what to charge for each product? That’s where HS / HTS Codes come in.

What are HS or HTS Codes and how do they impact my business?

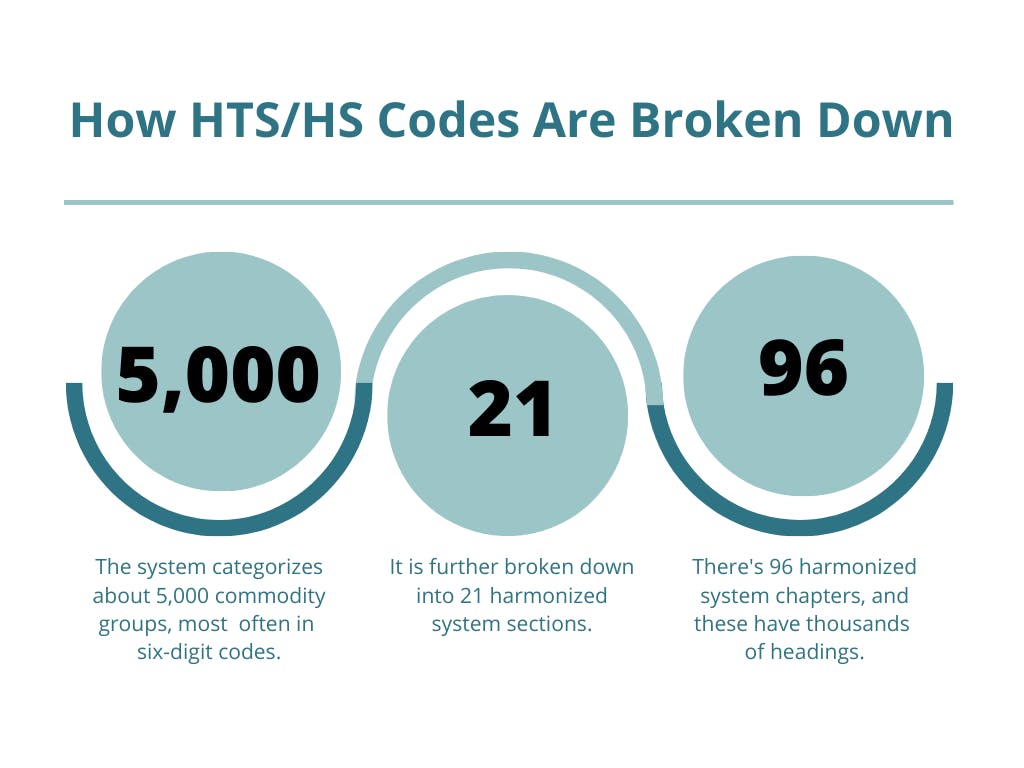

Developed in 1988 by the World Customs Organization (WCO), the Harmonized Systems Code (HS or HTS Code) was introduced as a global product classification system to standardize internationally traded products, making it easier to classify different items. The codes are maintained by WCO and are updated every five years.

How do you read an HS/HTS code?

The first two digits of the code indicate the product category, while the next four to six digits indicate the subcategories the product fits into.

Occasionally, countries can add more digits to identify products even more granularly, taking the code up to as many as 10 digits. These additional country-specific codes can be changed at any time by the country using them. The additional digit HS Code used by a country is known as a “tariff line.”

What Happens at the Border

The person arranging the customs clearance will need to use HS Codes to submit to customs in the country of import to confirm the rate of duty or tariff that is payable when importing into the country. It is critical to provide your customs point person with as much detail as possible about the products, so they can correctly and easily clear the products through customs.

If the wrong HS Code is used, importers can face surprises in the form of higher than expected duties, lower duties or even not pay duties at all.

However, if the wrong HS Code is used to clear goods, you could be on the hook for fines and penalties, even well after the goods have cleared customs.

If you need assistance with HS Codes and understand the true cost of your upcoming import, Moselle is happy to help!